AR Financing

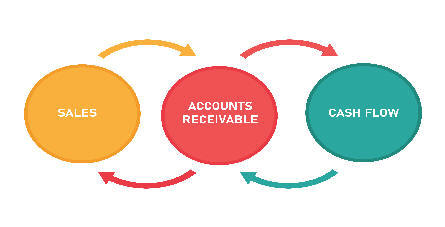

Our accounts receivable financing options include invoice factoring and a receivables line of credit. These solutions are ideal for companies that invoice on credit terms, helping them maintain strong cash flow or address cash flow deficiencies caused by unpaid invoices.

Unlock Immediate Access to Capital

By leveraging these financial options, businesses can unlock immediate access to working capital, enabling them to invest in growth opportunities or cover operational expenses without waiting for customer payments.

Remain Competitive

These two options provide essential flexibility for businesses striving to remain competitive in today’s fast-paced market. This is particularly important as buyers and customers increasingly request credit terms, which can lead to cash flow challenges. Invoice factoring serves as a solution to these issues.

Some of the Benefits:

- Meeting payroll regularly

- Non-recourse factoring means that the factoring company assumes the risk of non-payment by any customer whose invoices we are factoring for you.

- Factoring services in the millions are available to support your company's continued growth.

- Facilities tailored to fit the client's funding needs

- Secure online access to your account

- Perform free credit checks on your customers 24/7 (keep track of your customers' credit standing).

- Invoicing and collections are included.

- Short-term or open-term facilities

- Competitive rates and flexible terms

- Funding startups and well-seasoned businesses

- A simple factoring application process for quick funding

- Plus, other features

For more information about accounts receivable financing, please click the Get Started button below to contact us. We will respond to you shortly.