Receivables Lines of Credit

Flexible accounts receivable credit lines help companies maintain their resourcefulness. The asset-based line of credit is tailored to meet the specific financial requirements of each business.

In addition to lines of credit, we provide various funding options, including accounts receivable financing, invoice factoring, and equipment financing. We design these options to help companies manage payroll and other operational expenses with ease.

We are a corporate finance company with a shared mission: to support businesses in staying competitive and resourceful amidst the challenges of rising competition and operational costs.

Our ABL line of credit products is available in most industries:

- Apparel-fashion

- Distribution

- Food service

- Healthcare

- Janitorial

- Manufacturing

- Printing

- Staffing

- Transportation

- Wholesale

Our funding solutions include:

- Receivables lines of credit

- Invoice factoring

- Equipment leasing and finance

- Inventory loans

- Commercial real estate mortgages

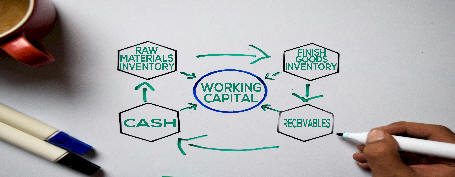

- Working capital loans that can improve efficiency

If interested in just factoring, please click here.

Line of credit uses:

- Refinancing

- Debt Restructuring

- Working Capital

- Acquisitions

- Expansion/Growth

- Reorganization/Meeting Expenses

- Leveraged Buyouts

LEDGERED LINE OF CREDIT

Compare the traditional line with a ledgered line of credit:

A ledgered line of credit, also referred to as a receivables line of credit, provides many of the benefits associated with a traditional bank line. However, it lacks the restrictive conditions that can obstruct a company's growth if a financial covenant is not met during a review of its recent financials or an audit. In contrast, a ledgered line of credit does not impose such limitations.

This option is ideal for companies that are considering a traditional line of credit or currently utilizing asset-based lending or a bank line, as it allows them to move away from stringent requirements while retaining the benefits of a line of credit and competitive pricing. The line is flexible and secured by the company's accounts receivable. Unlike a traditional line of credit, it does not require audits or impose restrictive covenants related to ratios, concentrations, or other financial metrics.

HERE ARE THE OBVIOUS ADVANTAGES

- No audit requirements

- No restrictive financial requirements

- No restrictive covenants

- No financial ratio requirements

- No concentration restrictions

- No long application to the funding process

- Plus other benefits

Is your company refinancing, expanding, or restructuring? Please don't hesitate to contact us 24/7. One of our ABL managers will get back to you shortly.